.jpg?width=1800&height=500&name=Untitled%20design%20(16).jpg)

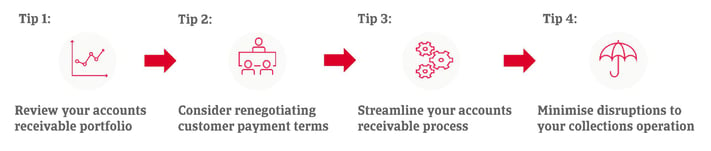

4 tips on how to limit bad debt losses during times of economic stress

Receivable management

Are your customers paying their bills on time?

Strained supply chains, high shipping costs and a slowdown in global economic growth, is putting increased pressure on cash flows. This in turn can lead to a deterioration in payment behaviour by customers. During periods of economic stress, you can minimise the risk of bad debts and optimise your collections processes with simple credit management steps.

Step 1: Review your accounts receivable portfolio

Identify the accounts that are more likely to encounter liquidity problems during the coming months. Perhaps your customer is experiencing cash flow issues and is at increased risk of defaulting on payment. Or perhaps your customers are located in a region where an uptick in insolvency levels is predicted, such as South Korea, Australia and Singapore during 2022, followed by Hong Kong and New Zealand in 2023. By assessing and categorising your portfolio, you can focus collections strategies on the accounts that need them most. To start, we would recommend grouping your customers into one of three tiers:

-

‘Good’ for customers that demonstrate good payments behaviour and where the contraction in global growth appears to have little or no negative impact on their sector

-

‘Fair’ for customers in a relatively good financial position, despite operating in sectors experiencing strain

-

‘Poor’ for customers demonstrating deteriorating payments behaviour, who are showing signs of financial stress and whose sectors have been deeply affected by global economic challenges.

Step 2: Consider renegotiating customer payment terms

Adjusting payment terms can help you maintain dialogue with your customers and help you build relationships while you try to increase the chance of payments being settled. For instance, you could consider giving incentives to encourage early payments. Sometimes even small discounts can speed up the collection process during periods of economic hardship.

Another suggestion is to offer customers short-term relief – such as suspending interest and late fees – in exchange for prompt payments. Meanwhile, for customers that have severe cash flow issues which could prevent them for paying their bill in full, consider working out a plan to receive a partial payment in the short-term. This is preferable to writing-off the whole debt in the event the economic downturn worsens and may help increase customer loyalty moving forward.

Step 3: Streamline your accounts receivable processes

In normal economic conditions, minor shortcomings in your accounts receivable process may not be a problem. However, during periods of economic stress such as in the current global trade environment, it is important to have an efficient credit management system in place.

Ensure regular monitoring of key metrics so you can detect any potential cash flow problems early. KPIs to consider include accounts receivable turnover ratio, days sales outstanding and accounts receivable ageing.

It is also worth reviewing your company’s accounts receivable processes. Look at the way invoices are sent and collected, and how transactions are recorded. Are you offering payment options that make it easy for customers to settle their bills? Are these recorded in a central database?

Importantly, while it is normal to make ad-hoc changes, it is essential that customer data is kept up-to-date in a central repository and unauthorised changes are prevented. Having an accurate record of any special arrangements also allows your company to send invoices without errors, execute collections with the correct approach and manage disputes effectively without confusion over the details.

Step 4: Maximise the efficiency of your collections operation

Consider establishing a partnership with a professional B2B collections agency.

A B2B collections partner can help you:

- Adapt your collections approach to changes in your customers' circumstances

- Resolve both domestic and international outstanding payments

- Practise an amicable collections approach to preserve good relationships with your customers, escalating to legal proceedings only when necessary.

If you have a credit insurance policy, your insurer may provide a debt collections service. Ensuring your accounts receivable and debt collection processes are optimised to operate through periods of economic stress will help you secure your cash flow and support your company with the financial flexibility and resilience needed to survive economic downturns.

All content on this page is subject to our Disclaimer, available here.

%20(1).jpg?width=56&name=RoelandPunt_BlackandWhite_lr%20(1)%20(1).jpg)

%20(1).jpg?width=66&name=RoelandPunt_BlackandWhite_lr%20(1)%20(1).jpg)